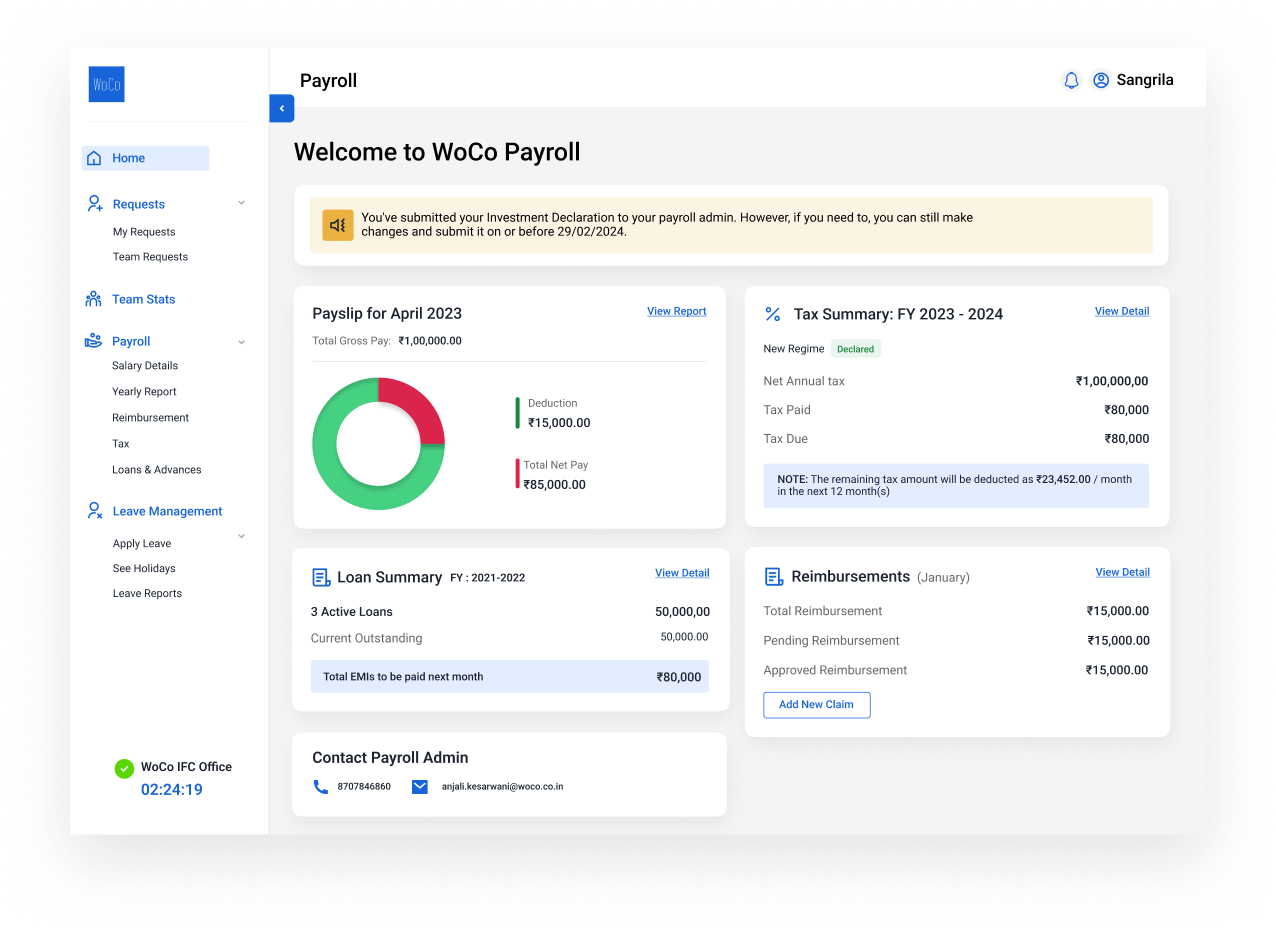

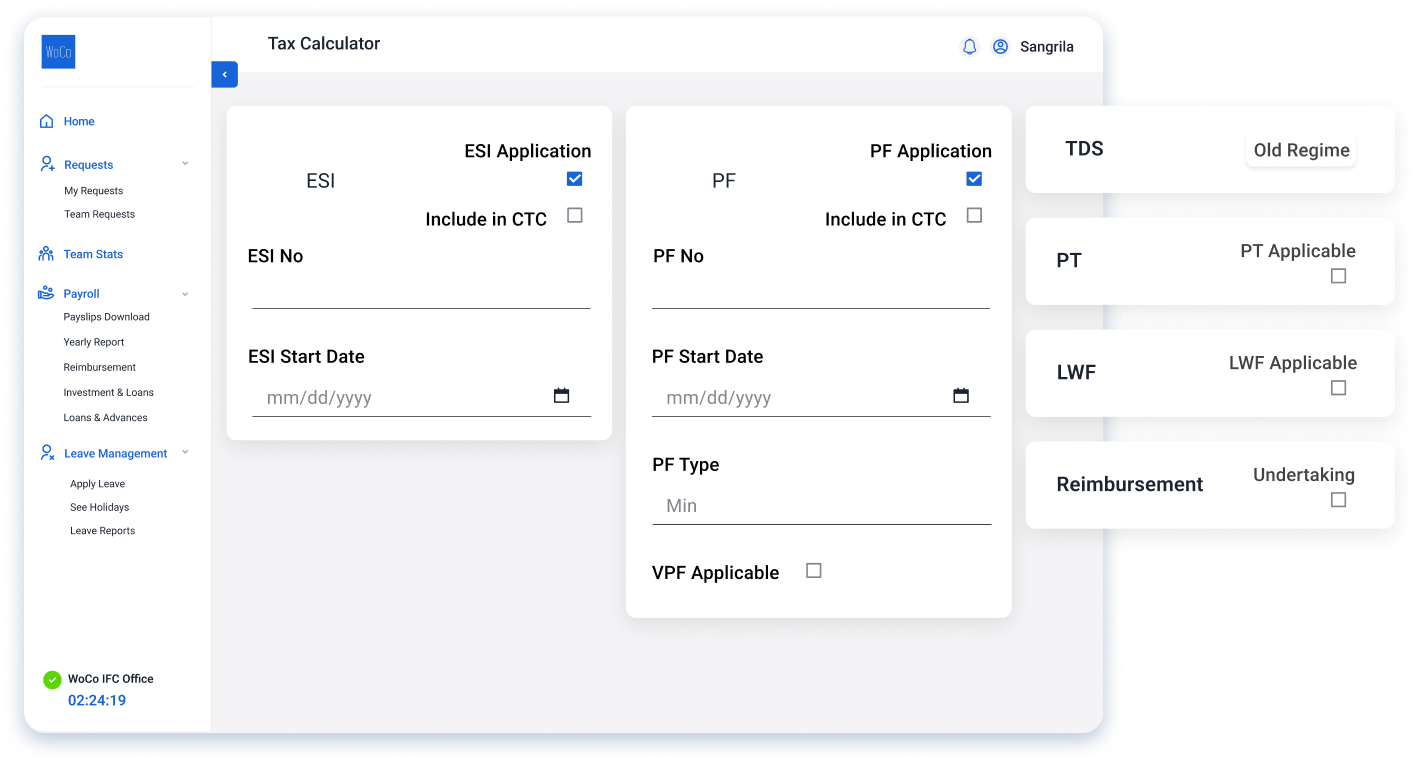

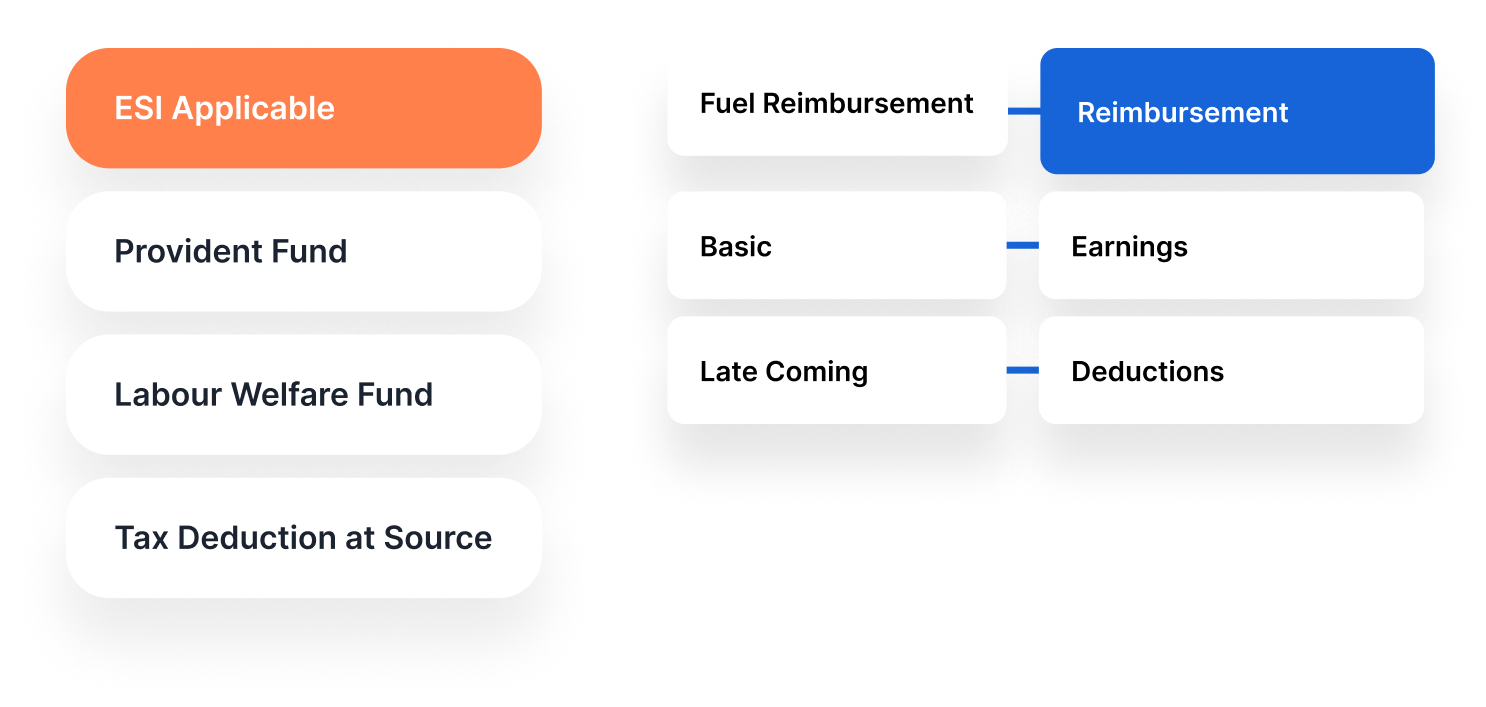

Payroll Compliance Software

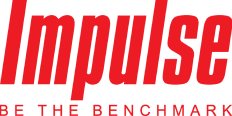

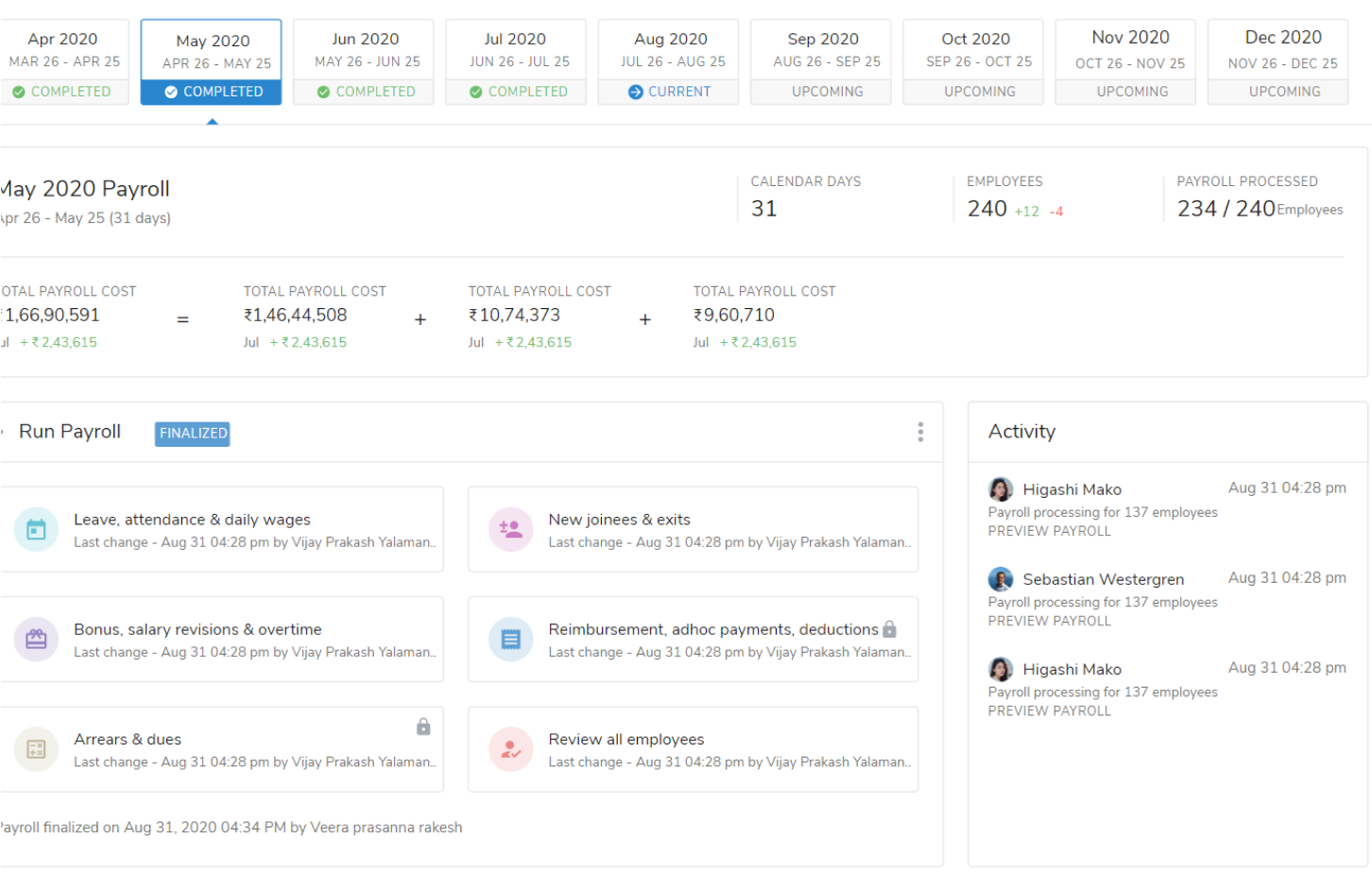

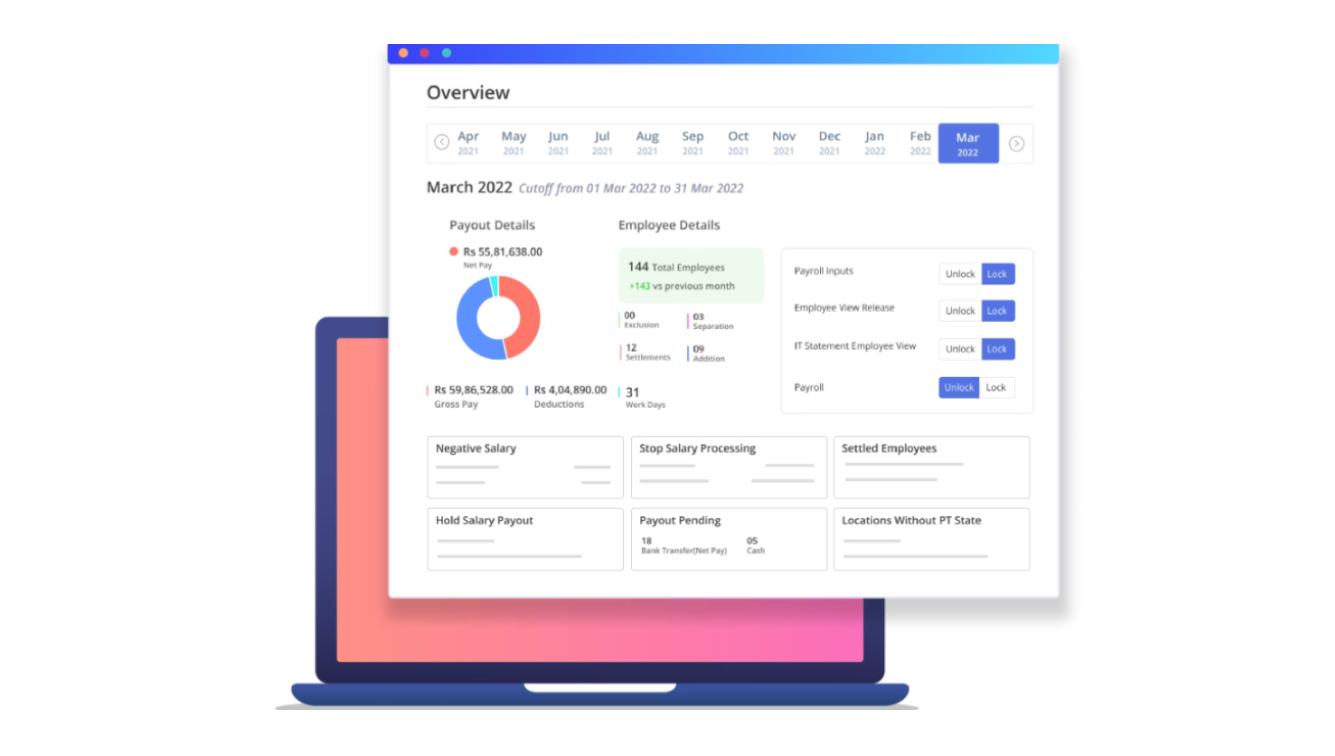

Payroll Software that is 100% Compliant, Accurate & Automated

Ensure complete compliance with tax regulations, timely payments, and error-free payroll—all with the right payroll compliance software to protect your business from compliance risks and penalties.